2 min read

Is It Time to Rebrand Your Association?

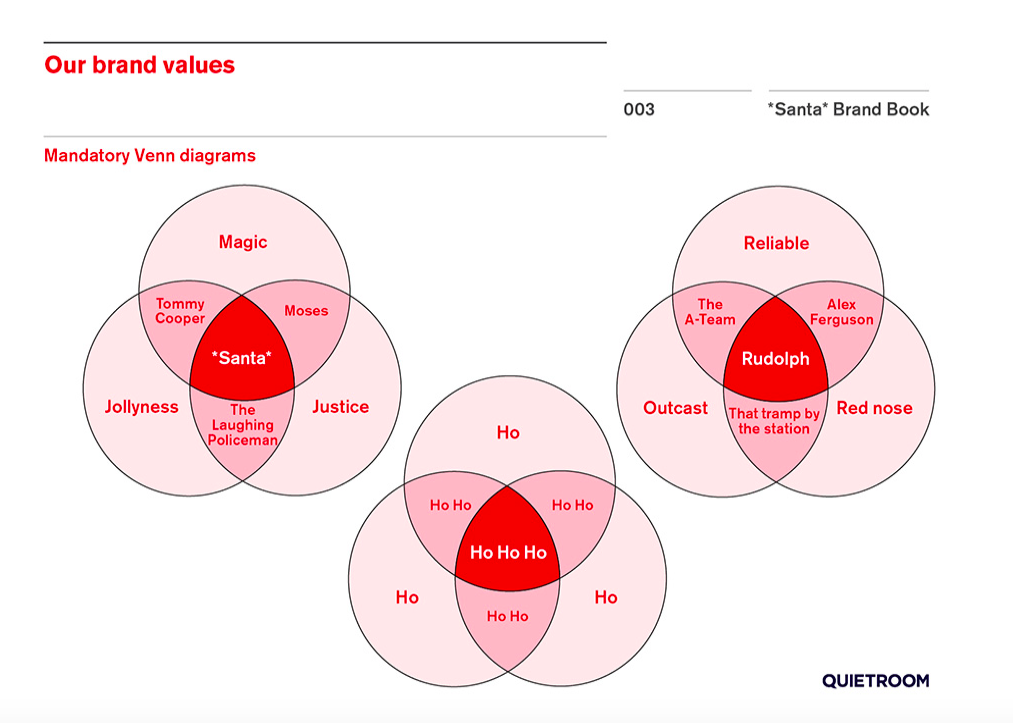

Santa Claus, the Brand “*Santa* is a Concept, not an idea. It’s an Emotion, not a feeling. It’s both Yesterday and Today. And it’s Tomorrow as well.”

“Bitcoin [...] ought to be outlawed, it serves no useful social function” -- Nobel laureate economist Joseph E. Stiglitz on Bloomberg, November 30, 2019

Love it or loathe it, the cryptocurrency bitcoin is on fire.

Bitcoin has, at the time of this writing, crossed nine all-time highs in late 2017, moving in valuation from $10,000 to $100,000 per coin. There is no consensus about its legitimacy amongst mainstream financial leaders, either. Is it the future, or a fraud? Or, as The Guardian opines, a potential "gold mine”?

Investors large and small are jumping in -- and what is happening now is already impacting Associations.

Bitcoin with the lowercase “b” represents the virtual coins, the cryptocurrency. Written with a capital “B”, Bitcoin refers to the underlying technology that makes it possible. Bitcoin created blockchain technology.

Blockchain technology is the engine that will be beneficial for Associations.

Bitcoin allows parties to exchange value (bitcoins) anonymously and securely. Transfers are immediate and global. There are no chargebacks or fees, as with credit card or international bank transactions. Among the benefits is its growing function as a global currency.

Bitcoin is not the only blockchain.

Most dramatically, blockchain eliminates the costs associated with middlemen. A typical Association pays numerous middleman fees annually. All of these directly impact operational costs and revenue.

Is the technology ready for prime time use by everyday people? Not yet.

One reason is security. Bitcoins only exist as a string of hashed numbers. (Hashed numbers are cryptographically secure.) While bitcoins cannot be duplicated they still risk theft. Currency exchanges and mining pools are hacker targets. Individual wallets are even more precarious. This is a potentially combustible situation.

Yet, blockchain technology is not going away. Blockchain infrastructure has moved into mainstream banking. Bank of America’s patent filings for blockchain transfers is one example. As a result, legacy automated clearing house (ACH) processes are being rapidly upgraded.

This sweeping trend is great for Associations. Directly and indirectly this enables faster financial transactions and lower fees. And maybe even more donations...

AssociationNow quotes industry research by ConsumerQuest. Fast banking transactions have a very positive effect on Associations:

“donors who used direct ACH payments gave more than twice as much as donors that used other means such as check or payment card—a difference of $1,700 to $650 over 12 months. The research went on to note that payment cards were more likely to be reissued because of fraud concerns, leading to payment disruptions, and that ACH payments tended to have smaller fees on the whole compared with credit card transactions.”

Non-profits particularly benefit. NACHA, the Electronic Payments Association, offers a toolkit to grow a donor base using ACH.

NACHA, the Electronic Payments Association, has been working for several years to speed clearance time between bank accounts.

Consumers overwhelmingly support near-real-time banking.

NACHA states in their Same Day ACH Report:

Few Associations should consider active investment in bitcoin at this point. Tremendous gains bitcoin may be attractive but price fluctuation will be too chaotic for most balance sheets. Enter cautiously.

However, blockchain technology should be on every Association’s radar. The security benefits and cost savings will be beneficial. Keep an eye on developing enterprise-level solutions as faster and cheaper options for money transfer arise.

Forward-looking Associations should also:

Be prepared! The benefits of blockchain will reach your Association sooner than you think. You don’t even need to hold bitcoin to benefit.

eBallot helps Associations host elections. Contact us for further information.

2 min read

Santa Claus, the Brand “*Santa* is a Concept, not an idea. It’s an Emotion, not a feeling. It’s both Yesterday and Today. And it’s Tomorrow as well.”

Running an effective association means that your members are actively being inspired to engage and advocate for the issues you care about, but...

There are many reasons why your association numbers might be dwindling: low engagement, lack of offerings, or lack of renewal interest are just a few...